WPay

Services

WPay

Services

Get access to SEPA, SWIFT and local payment networks for truly multi-currency banking.

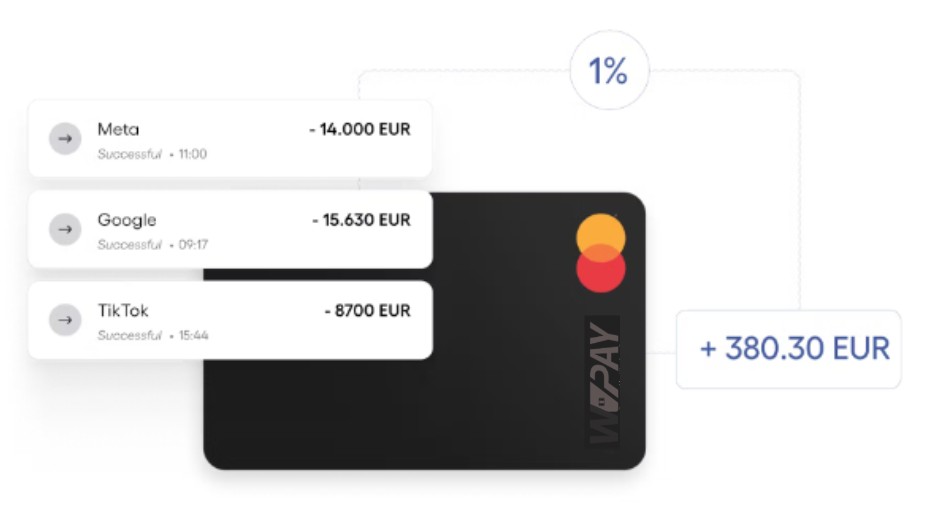

New! The card that automatically adapts to you with 1% cash back

Streamline your business expenses with corporate cards, saving your accountants hours of work. - Issue a set number of corporate cards as your team grows - Control spending, freeze or cancel cards anytime, anywhere - Spend smart and earn more: get 1% cashback on every purchase - Virtual and physical cards controlled by user permissions.

Get Started TodaySecure, Convenient Banking

Start taking payments on your website with a uniquely bundled package that includes both a merchant and business account. With WPay, you soon benefit from same-day settlements — unlike most other providers that can take days to pay out funds.

- No hidden fees.

- 100% security. Guaranteed.

- No training or maintenance needed

About Our Products

Payment Gateway

A flexible payments platform engineered for universal possibilities.

“In a global marketplace with increasing cross-border spend from tourism and online transactions, it is important to offer end merchants the ability to accept all major card types.”

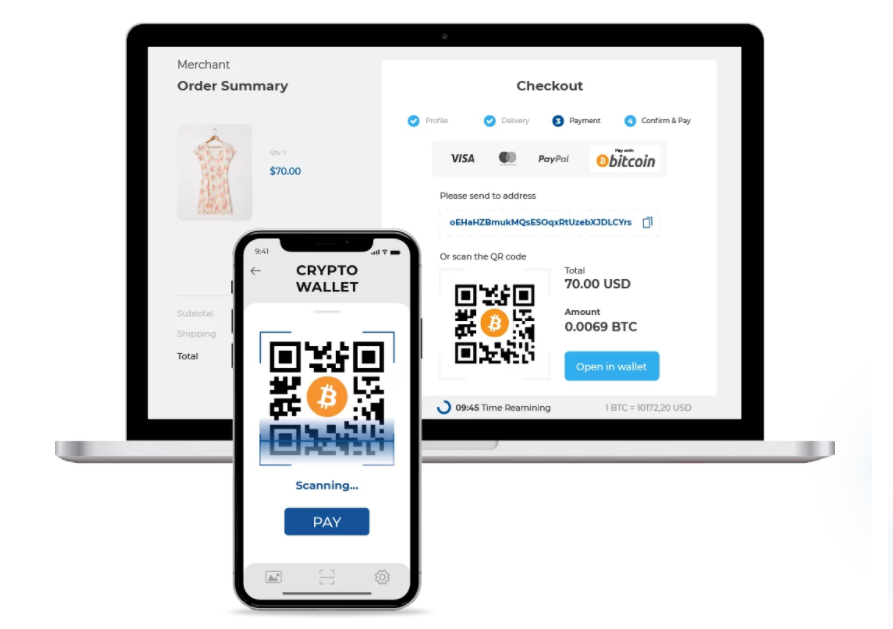

Crypto Gateway

Reach over 575 million crypto-consumers via a wallet-agnostic solution.

“WPay’s ability to authenticate the origin of funds and the duration of digital assets in a particular wallet earns it the distinction of being an approved solution by Fannie Mae and Freddie Mac.”

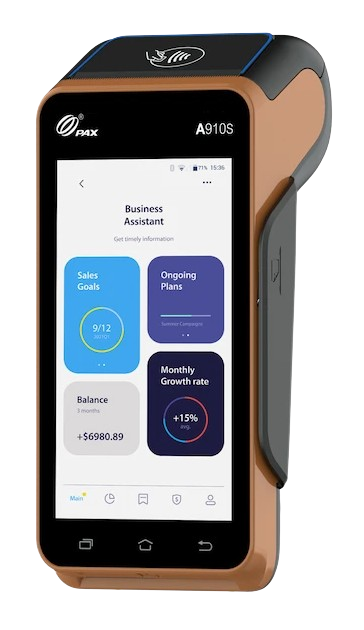

POS Terminals

Stay ahead in retail with shopper-centric solutions

“Whether you’re a sole trader or a multinational chain, you’ve got the goods. To keep those tills ringing, let your customers pay, their way – whether it’s online, in-app, by phone or in-store.”

Hosted Checkout

An International Online Checkout Solution with Less Development

“Whether your online business sells B2B or B2C, you need to offer cards, plus local and alternative payment methods such as bank transfers, ewallets and even cash to reach international buyers.”

Support

Frequently

Asked Questions

Got a question about how we’re organised, applying to work for us, or looking for financial or shareholder information?

Details vary depending on the payment method. It’s usually a combination of phone number, the recipient’s full name, their bank account number and their BIC/SWIFT number. Sometimes, we may ask you for the city as well.

Different payment methods affect your transfer delivery time. Payments to other WPay users and card payments are instant. Transfers to cards typically take a few minutes but can take up to 30 minutes. International transfers can take up to 1 minute to 2 business days to reach the recipient’s account. Check out the pricing widget for more details for your transfer.

A Payment Gateway it is the first step in the payment process the Cardholder will come to and is a facility that allows a Merchant to take a payment where the Cardholder is not present. The Gateway will either authorise or decline the transaction based on the data entered and/or the settings of the Gateway, it will pass approved transactions to the Merchant Account for settlement.

Logging in using 2FA is required to change specific settings within the MMS. The Google Authenticator Guide goes through the steps required to set up the Google Authenticator app on your mobile device (there is also an option to receive codes on your pc via a browser extension). This app allows you to use two-factor authentication (2FA) with MMS. Once configured, you can use the Google Authenticator app to receive codes. You can set up Google Authenticator or another app that creates one-time verification codes when you do not have an internet connection or mobile service. Once you have received the code, enter it on the sign-in screen to confirm it is you. Alternatively, you can consider using other applications like Authy, LastPass Authenticator etc. NB: this is a one-time registration process, and only one 2FA authenticator can be used per user account.

3D Secure authentication was developed by Visa with the intention of improving ecommerce payments’ security and cardholder confidence. MasterCard has also adopted the service, along with JCB and Amex. The full 3D Secure service is available using the Woohoo Pay Payment Gateway and there is no additional charge for this service. Fundamentally, 3D Secure allows the cardholder to create a unique password for their relevant debit or credit card. This works very much like the PIN would with a PDQ machine in order to authenticate a payment, as only the cardholder should know that password. 3D Secure stands for 3 Domain Server, relating to the three parties involved with the process: the Merchant, the Acquirer and the card issuer. This process is the most recent of fraud prevention services available for eCommerce Merchants and cardholders to use. In addition, 3D Secure also assists the merchant’s liability cover for each transaction authenticated by the process. We would suggest checking with your Acquirer as to what exactly this covers. Chargebacks can still happen, as this will still be decided by your acquirer. Further information about 3D Secure can be found within the relevant integration guides.

Try our service now!

Eyerything you need to accept WPay payments and grow your business

anywhere on the planet.